- Stock Therapy with Penny Queen

- Posts

- How My Stock Picks Hit 184% Average Peaks (and What’s Next)

How My Stock Picks Hit 184% Average Peaks (and What’s Next)

From 4.6x moonshots to 30% lessons, here’s how my picks performed.

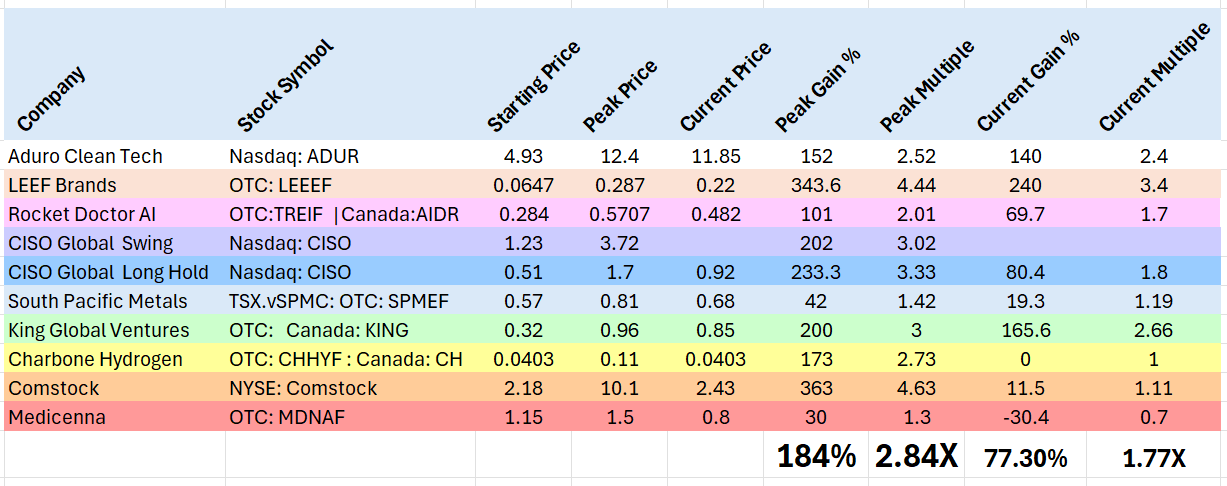

Since companies are reporting their quarterly earnings, I figured it’s only fair I report mine too. Over the past year, every stock I’ve covered here on Substack (and in Discord) has had its chance to run… some quietly, some explosively. On average, my picks reached +184% peak gains (2.8x), and even after the inevitable pullbacks, they’re still sitting at a healthy +77% current gain (1.8x). Even my “worst” pick had a +30% run before retracing.

Two quick requests before we dive in:

Share my Substack. It’s free and always will be. More eyes on these stories means more sustained momentum for the companies I cover.

Tell me your best pick. My research gets better with your suggestions. Drop me your favorite stock and why you like it. I’ll be paying attention.

Now let’s get into it. I’ll walk through each company, where things stand today, and where I think they’re headed. As always, I don’t tell people when to sell, t

he best way to measure opportunity is to look at where the story started, how far it ran, and where it is now.

ADURO CLEAN TECHNOLOGIES: 152% peak gain

Nasdaq: ADUR | Canada: ACT

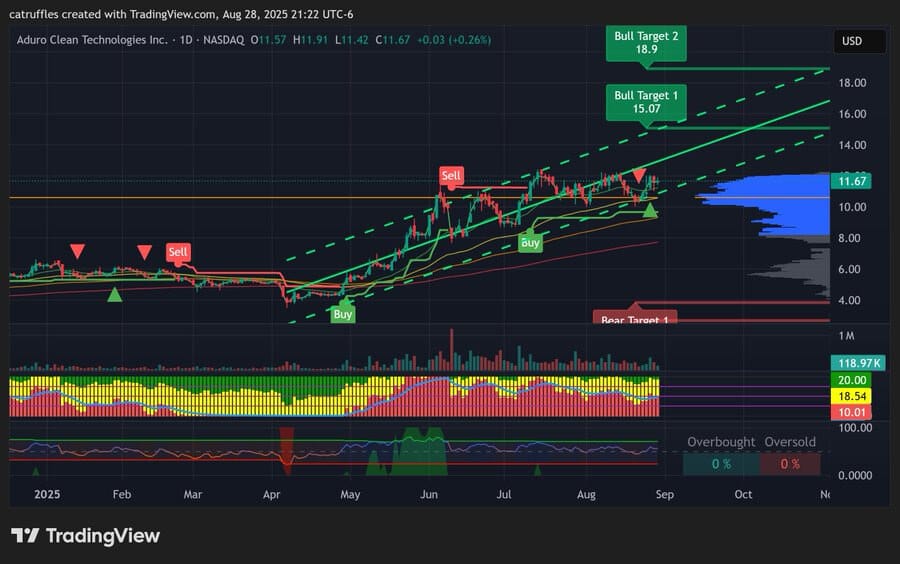

This ran from about $5 to $12.40 and is sitting at $11.850. What is most notable is that there is a $48 analyst target on it that is sounding more and more realistic. The company has their Next Generation Plant commissioning this month and next. This is a major step up in size and should be major in terms of recognition. They seem to have the most robust plastic recycling technology out there. It can handle contaminants and unlike other processes it handles 4 f the 7 types of plastic with great yields. They are coming to the end of the GameChanger program with Shell and have been successful in a program that is built to fail companies. I don’t know what the end result of this program will be, but other companies that have graduated have gone on to do great things, with and without Shell.

Last week, also announced that they are running a marketing campaign with three large groups. I am very excited about the implications of this. Does it mean they have big news? Have they figured out the importance of retail attention? The price has been moving up steadily along with a growing retail audience. Over the past few months there has been a lot of (free) coverage by The Long Investor on X and that alone has had a huge impact. The chart looks more than primed. I think by this time next year, it will be a further 2x in my portfolio. Aduro is also sitting on about 15m USD by my count and don’t forget their 6 multi-billion-dollar clients.

I’ve been here since IPO at the equivalent of $2 and I expect to be here in the $50sThe chart below was done by @CatRuffles on X.com

Price Target 1 - $15.07 | Price Target 2 - $18.90

LEEF BRANDS: 343% peak gain

US OTC: LEEEF | Canada: LEEF

This has already been a great play, but this has always been a Q3 play. We have a cannabis concentrate producer that has their own 1900-acre cannabis farm with the ability to produce 3.2m pounds a year. The company has a market cap of about ~42m USD with the farm independently valued at $40m They are expecting 54% margins in 2026 and over 50m USD in revenue. Q3 numbers are where we will see the improvement. This plus cannabis rescheduling looking more and more likely and the potential of the MSOS ETF picking up the company and we should have a great year here.

ROCKET DOCTOR AI: 101% peak gain

US OTC: AIRDF | Canada: AIDR

This post disseminated by Rocket Doctor AI

(As of Tuesday, August 2nd the US OTC stock symbol is AIRDF)

This has only been in my portfolio for about a month but if it scales like the company anticipates, I expect the price could scale as well. Rocket Doctor AI just posted its first significant revenue quarter with $0.5M and an 89% gross margin, early proof that its model scales. Don’t get me wrong, we are still a way out from net profit territory, but the story now pivots to U.S. expansion. Rocket Doctor has already secured California and New York Medicaid partnerships, covering a combined population of more than 7.3 million lives. With reimbursement around $18 per virtual visit, even modest adoption could move the needle fast. It is important to point out that so far, their CAC (customer acquisition cost) has been right around $5, in Canada, customers have averaged 1.2 visits so far. We expect the US to have a higher visit rate with the existing contracts due to the number of chronically ill patients in those systems (on average this is between 4-5 visits).

Run the speculative math: at just 1% penetration, these two contracts alone could yield ~$1.3M annually. At 5%, the figure jumps to ~$6.6M, and at 10% penetration, more than $13M per year, a potentially powerful revenue stream for a company that just booked its first half-million. With a fresh $3.08M oversubscribed financing closed on August 21, Rocket Doctor is positioned to accelerate adoption and prove out these scalable contracts. If execution follows, this is where the growth story starts to show its true size.

I have an interview planned with Dr. Hamza and Dr. Cherniak later this week to cover some of these details.

CISO GLOBAL: 233% Peak Gain

Nasdaq: CISO

CISO has had two lives in my portfolio, first a chart only swing play that peaked at 2x and then as a real due diligence pick that has been all over the place and is sitting at about a basic double right now. For retail this has been moving slowly over the past couple months. At one point, we had around 90% of the stock locked up by retail, insider and friends and family. I am not sure where it sits today. Over the past couple months, the company has cleaned up their balance sheet (which was likely the cause of the heavy manipulation) and they have launched their high margin SaaS business. There are a lot of moving parts here, but retail is waiting on an IR team, the company possibly delving into crypto with their cybersecurity products and maybe their balance sheet. Everyone is waiting for Q3 numbers. As a reminder the company had 30.7m in revenue last year, is valued at 30.8m. Beyond the regular services revenue, they are expecting to add 10m in high margin SaaS revenue to THIS year’s numbers. The valuations are just plain off, and I still expect to be holding this well into the $5s.

SOUTH PACIFIC METALS: 42% peak gain

US: SPMEF | Canada: SPMC

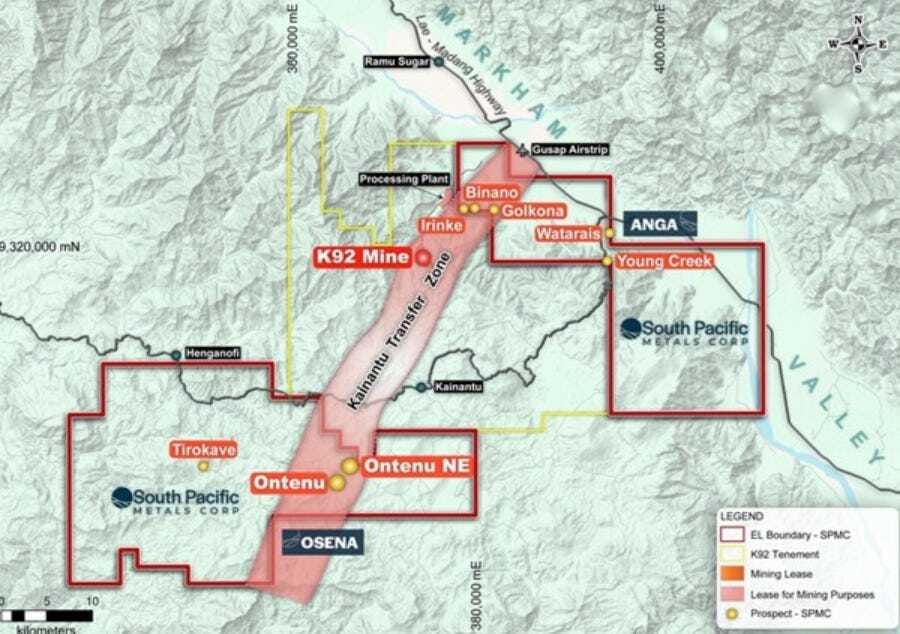

South Pacific is up 42% since my family started an advertising contract with them last month, although they are not currently running any ads. I am not taking credit for the run, just letting you know that I am biased, I know the company and the CEO very well as 45 Degrees has been consulting on this project since 2024. I expect to put out a much deeper dive in the coming weeks, but you should know that they have land on the north and south borders of K92s massive 2.7-billion-dollar Kainantu project and South Pacific has a temporary injunction to keep K92 from operating on South Pacific’s land. If you want a basic idea of what they are working on, look here: https://x.com/Silver__Santa/status/1957517679352246564

KING GLOBAL VENTURES: 200% Peak Gain

Canada: KING | US OTC: KGLDF

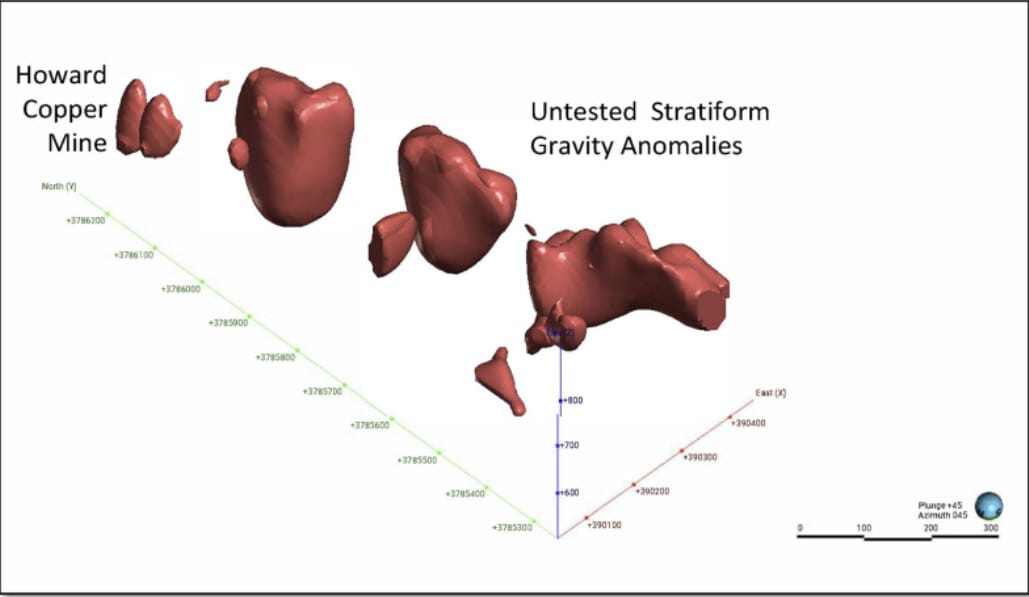

King Global ran hard into June, tripling since the beginning of our consulting contract. Our contract ended in June, but I am still happily holding my shares and looking for the $2 range. I expect this to get interesting toward the end of the year and the chart looks solid. The company is sitting on a pile of cash and the site of 15 former producing mines, where no modern technology had been used. They have an interest in the ghost town of Cleator, AZ which is expected to be featured on HGTV’s Zillow gone wild in September. So far, they are partway through a 10k foot drill program and have found some striking anomalies.

CHARBONE HYDROGEN: Peak Gain 173%

US OTC: CHHYF | Canada: CH

Charbone has to be my most annoying holding. While the peak gain was 173% and it had three solid runs this year, it is sitting at 0% for the year. What is most frustrating is that the company has 50 million dollars US in project financing, which is enough to get several clean hydrogen facilities up and running. Each facility should be profitable from the first phase, and yet we are still waiting. It is the only publicly traded pure-play hydrogen company and there is huge industrial demand. In short, Charbone has a market cap of 6.3m USD, access to 50m USD non-dilutive funding and no real communication to the market. I can see this getting re-rated once they have the first plant up and investor trust back, but for now I will call this my worst pick for the year. Full disclosure: I am holding 2 million shares

COMSTOCK: 363% Peak Gain

NYSE: LODE

I considered not having Comstock in the portfolio, but rules are rules. It is a bit of an outlier and I derisked my investment heavily when it had a crazy run in December, but I have continued to provide video interviews on the company on my StockTherapywithPennyQueen YouTube account. Comstock is an absolutely complex beast. It is three or more companies rolled up into one. Two of which, Bioleum and Metals could become major pieces of global decarbonization. The corporate structure is very complicated, and I have spent hours trying to make it make sense to retail and myself. I will continue to follow it, hold my existing investment in it (which was made at an equivalent of $1.20) and wait for the ideal entry to grab more.

MEDICENNA: Peak Gain 30%

US OTC: MDNAF | Canada: MDNA

So, the peak gain was 30% but the current state of play is -30% from one year ago. I make no apologies for this pick. It has been in my portfolio for a couple years and I doubled down when it was delisted and relegated to the OTC in the 40-cent range. This is a biotech, they are truly trying to cure cancer and having amazing results that are not being recognized by the market. They completely irradicated several patients’ tumors entirely.

Biotechs are binary plays most of the time, if they get approval or a buyout, the returns are astronomical. The flip side is a zero. Invest accordingly. Over the years as the data has come out, and they have become the leader in the IL-2 space, my conviction in the play has become a lot stronger. Medicenna is a very technical play, you can watch some of my old videos if you are interested in the science, but I recommend following David Bakke’s Substack dedicated to the company.

That’s my year…. wins, misses, and lessons. Now it’s your turn: what under-the-radar stock should be on my radar? I’m especially hunting for a low-float setup, more clean tech and maybe a litigation play. Drop your tickers in the comments and let’s find the next 2–4x together.

As always, this is not investing advice, and I am not an investment advisor. Investing is risky, do your own due diligence and protect your capital. The ideas expressed in this and all of my SubStacks represent my opinions. Do your own due diligence and protect your capital. XO Penny

Required Disclosures

45 Degrees, Inc (“We” or “Us”) are not securities dealers or brokers, investment advisers or financial advisers, and you should not rely on the information herein as investment advice.

Rocket Doctor AI will make a total payment of $180,000 USD and 400,000 options at .45 CAD to provide marketing services for a term of 6 months. We or certain non-arm’s length parties own 30000 common shares of Rocket Doctor AI.

South Pacific Metals entered into a 6-month advertising agreement with 45 Degrees, Inc on July 29th, 2025. 45 Degrees will be reimbursed for advertising expenses and has received 150,000 options at 55 cents CAD in compensation.

This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. This does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or constitute an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures. It is our policy that information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Forward Looking Statements

This article contains forward-looking statements about Rocket Doctor AI Inc., which are identified by terms such as “anticipate,” “expect,” and “project.” These statements reflect current views regarding company performance, business goals, healthcare market expectations, and intellectual property development. The statements are based on current business and market expectations. However, they involve various risks and uncertainties, including potential delays, financial difficulties, operational challenges, and problems protecting intellectual property. Additional risks include possible regulatory approval delays, market disruptions, personnel issues, and competitive pressures. Given these risks and uncertainties, actual results may differ significantly from what is described in the forward-looking statements. Readers should not place undue reliance on these statements, which are only valid as of the article’s publication date and we undertake no obligation to update.