- Stock Therapy with Penny Queen

- Posts

- CISO Double Feature: CEO Interview + My Chart Breakdown

CISO Double Feature: CEO Interview + My Chart Breakdown

I don’t usually make public chart breakdowns - most of the time I’m just tracking my own setups.

I don’t usually make public chart breakdowns - most of the time I’m just tracking my own setups.

But after CISO’s Q1 earnings, margin expansion, and the wild swing from $1.42 to $0.66 overnight… a lot of people started asking what I was seeing.

So today, I’m sharing a 2-in-1 video post:

First up - a quick interview with the CEO of CISO Global. No commentary. Just a direct look at what’s happening inside the company as they work toward profitability and scale.

Then - a chart breakdown where I walk through what I believe is setting up to be another major move. I’ll cover Fibonacci extensions, RSI, volume signals, and why $5 this summer and $11.52 long-term are not just hopium.

Whether you're holding, trading, or just watching from the sidelines - this should give you both the signal and the setup.

Q1 Review with CISO Global CEO, Dave Jemmett

Chart Breakdown: Setup, Signals, and Scenarios

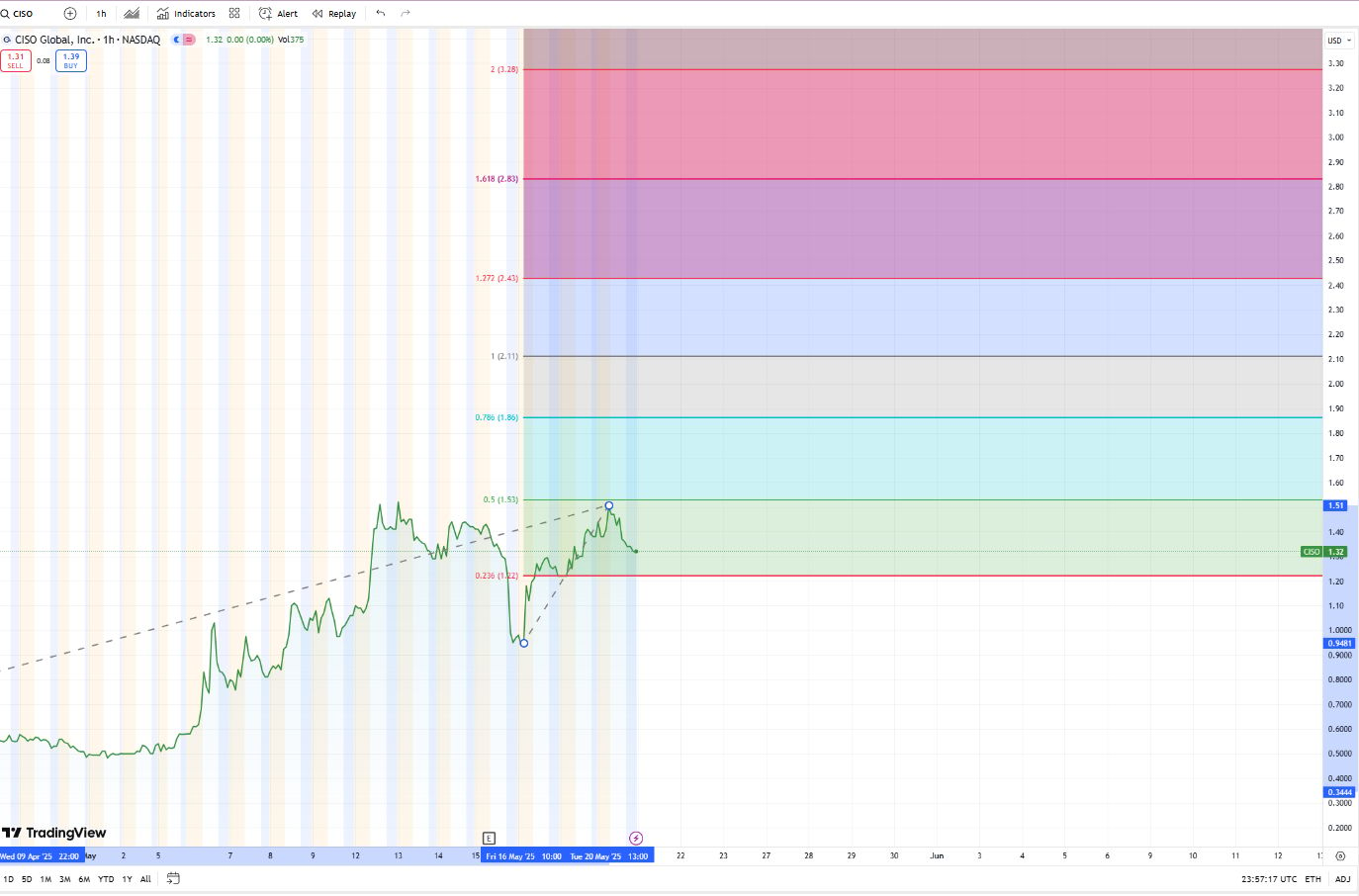

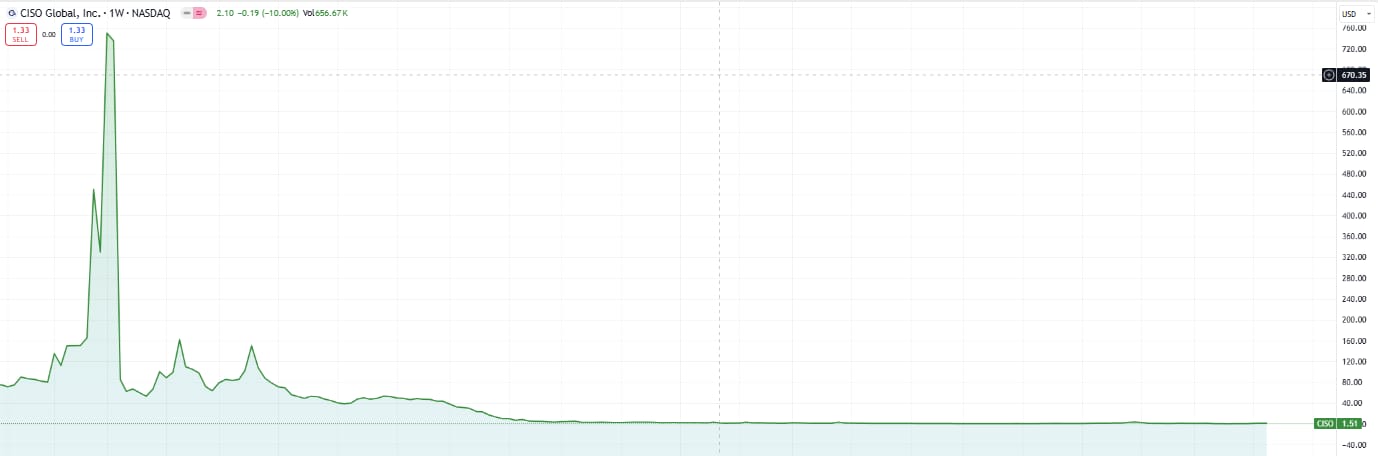

After months of accumulation, CISO Global ($CISO) is showing signs of technical strength that closely mirror its late-2024 breakout, one that sent shares from under $0.50 to $3.84 in just weeks. This time, the setup is different in one key way: the fundamentals have caught up.

In the video below, I’ll walk you through the Fibonacci levels, RSI behavior, and historical volume triggers that make $5 a plausible target this summer. And I’ll share why I believe the long-range fair value - assuming they hit 2025 guidance - could reach $11.52.

Déjà Vu: The RSI and Volume Say It All

RSI bottomed near 30…again.

Volume spikes over 60M mirrored the pre-December 2024 breakout.

Fractional share spoofing seems to have dried up…again.

“These aren’t coincidences. They’re signatures.”

Fib Levels and Summer Target: Why $5 Makes Sense

The recent move from $0.29 to $1.51 gives us clear retracement zones.

Holding $1.20–$1.40 supports continuation.

$2.20–$2.80 = decision zone. Breakout confirms the trend.

Extension points suggest $5 is the next psychological and structural target.

The $1.70 Target: Chart Meets Instinct

Some levels don’t come from textbook- they come from pattern recognition, instinct, and staring at the screen long enough to know when things feel sticky.

I’ve been flagging $1.70 as a near-term target for weeks. It’s not just a gut call - though it started that way. There was heavy churn near this level on the way down, and psychologically, it’s a spot where traders tend to make a decision: reload, or bail.

The $11.52 Scenario

This is not a next-week price target.

This is post-Q4 2025, guidance met, EBITDA stable, and recurring revenue priced in.

It’s a fair value reflection of a company doing:

$34M in high-margin services

$5M in software with 80%+ margins

Perspective Check

It’s worth noting that CISO previously traded as high as $15 (split-adjusted) and at that time, it had wider losses, less clarity, and was still in the early phases of integrating its acquisitions.

“The price isn’t the point. The structure is. If fundamentals continue to firm up, the market may eventually reprice accordingly — as it has before.”

The difference today is clear:

The model is shifting toward software

Margins are improving

Legacy debt is being cleared

And revenue is recurring

Share structure is tight.

No ATM usage.

Blackout period ends soon.

Earnings were solid, and the company is (finally) communicating.

“In a manipulated tape, fundamentals don’t create lift. They create the floor for when the games stop.”

I’ll be tracking volume inflection points, RSI trends, and daily levels on. If we cross $2.20, things could move fast.

Until then—watch the tape, follow the flow, and never ignore volume math.

Disclaimer:

I have no business ties to CISO Global and have not been paid for this content.This post is for informational and entertainment purposes only. Nothing in this content should be considered financial advice, a recommendation to buy or sell any security, or an endorsement of any company. Always do your own due diligence, and consult with a licensed financial advisor before making investment decisions.

I’m just sharing what I see - and what I’m doing - not telling you what to do.