- Stock Therapy with Penny Queen

- Posts

- CISO Doubles SaaS Forecast..... and It’s Just the Beginning

CISO Doubles SaaS Forecast..... and It’s Just the Beginning

Even conservative math says this stock is 3x underpriced.

2025 software bookings forecast doubled to $10 million.

Why?Because of the nationwide launch of CyberSimple, the white-labeled version of CISO’s CHECKLIGHT cybersecurity platform. It’s being distributed by Financial Independence Group (FIG) and supported by Cyber Assurance Group Inc. (CAGI), tapping into a $2 billion market.

This is something the company has been talking about for a long time, and now it’s finally launched. They have enough data points to confidently double anticipated revenue, and that matters.

But what I like even more than the actual doubling is how quickly it came after launch. That’s our strongest signal.

Let’s remember: CheckLight = CyberSimple. Same platform. Different brand.

CHECKLIGHT didn’t have any real traction in Q1 or Q2, this $10M forecast is built on just Q3 and Q4. So not only will next year’s SaaS revenue benefit from a full four quarters…I believe we’re going to see explosive growth on top of that.

And remember: Margins are what the market rewards.

The Math Is Simple (And It Matters)

CISO is forecasting $10 million in SaaS bookings for 2025, again, just from the second half of the year.

Let’s be conservative for a second and assume 2026 runs at that same pace (even though growth should accelerate).

Two quarters = $10M → Four quarters = $20M

Apply a reasonable 7x SaaS multiple, not outrageous given the warranty-backed model and national distribution, and the 2026 software segment alone could justify:

$20M × 7 = $140M valuation

That’s before we even talk about their services business.

Sum-of-the-Parts Valuation

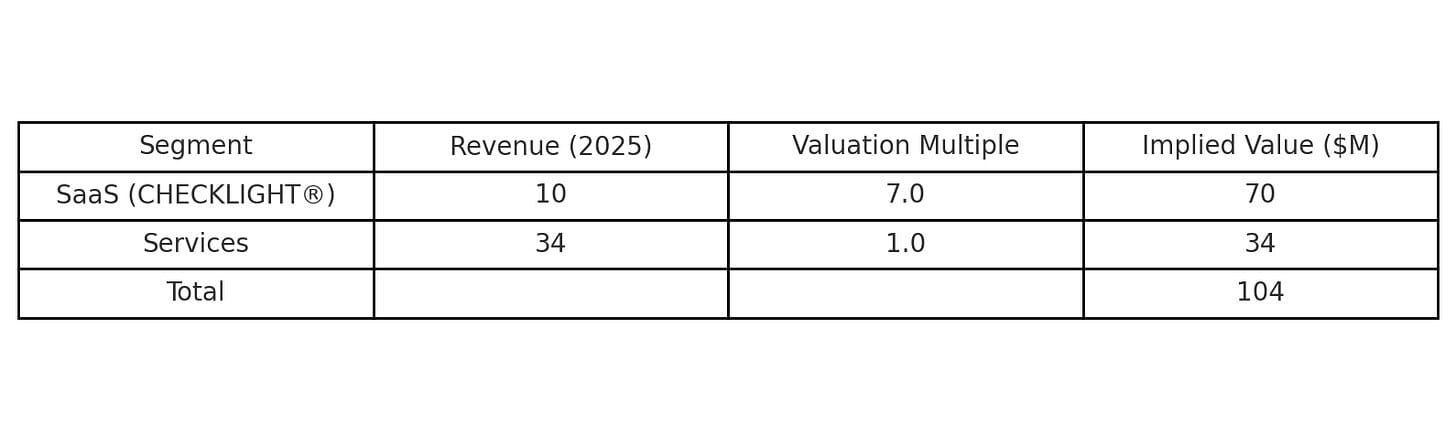

Here’s how I break it down:

Current market cap = ~$36M

That’s less than the SaaS business alone.

In other words:

💥 This should be a $3 stock right now……. and that’s without factoring in any 2026 growth.

Why CyberSimple Is a Big Deal

Most cybersecurity companies sell you software.CISO (via CyberSimple) is selling a warranty-backed cybersecurity solution, with $1.5 million in protection if something goes wrong.

Here’s what makes it different:

You can sign up online

Download the software

It runs quietly in the background

If you’re hacked, you’re financially protected

That’s it. You don’t need to understand cybersecurity. You just need peace of mind.

They can offer this protection because the system works.Over 100 million hours of run-time without a breach.That’s the part the market isn’t pricing in yet.

My Take

If you’ve followed my CISO coverage (I know there’s been a lot), you know the question was never:

“Can they make revenue?”

It was:

“Can they turn that revenue into something that scales, margins up, and gets valued like a SaaS company?”

Now we know.

Half a year got them to $10M. A full year could deliver $20M.

$20M SaaS × 7x = $140M

Current valuation: ~$36M

So, I’ll say it again:

I believe CISO is worth $3 right now…. and much more next year.

I know some shareholders are getting bored. The volume dries up, the price chops sideways, and it feels like nothing’s happening. But this is where patience pays.

Most of the market moves too fast to see the setup. They sell before the shift becomes obvious. But the real profit is in holding when it’s quiet, not when it’s trending.

This news was quiet. The impact won’t be.

And by the way…I’m working on something CISO-related that I think is going to be greatStay tuned.

Disclosure:I own shares of CISO Global. This is not financial advice. Always do your own research and protect your capital.