- Stock Therapy with Penny Queen

- Posts

- The $CISO Shakeout: Not Dilution, Not Retail - Just Market Mechanics.

The $CISO Shakeout: Not Dilution, Not Retail - Just Market Mechanics.

A full breakdown of the May 30 trading halt, CEO insights, and how market structure triggered a synthetic flush.

A Quick Note Before We Dive In

I love volatile stocks.

It’s not for everyone… but I believe the biggest mispricings and biggest opportunities live where volatility scares most people away. Stocks like $CISO don’t follow neat, stable patterns. They’re either wildly undervalued or getting forcibly shaken down by systems designed to flush out retail.

This post is written in layers. So, if you’re new to this stuff, just read until you feel satisfied. If you want the full breakdown, from VWAP to stop-loss traps to the CEO’s exact quotes - it’s all here. There are too many rabbit holes and things that need explaining to make this article beautiful, it won’t be as chaotic as yesterday’s trading but bear with me. I even added a glossary at the end

Disclaimer: This post is not financial advice. I am not a financial advisor. I was not paid by CISO or any third party to create or distribute this article. All opinions are my own, and this content is for informational and educational purposes only.

On May 30, $CISO was slammed from $1.43 to $0.66 - triggering a circuit breaker and a tidal wave of speculation. But here’s the truth: it wasn’t dilution, and it wasn’t retail dumping. I interviewed the CEO that same day, analyzed the tape, and collaborated with some of the sharpest traders on X and Discord. Here's what we found - no hype, no hopium, just data, charts, and mechanics.

🟢 Level 1: What Happened (Quick Recap)

$CISO dropped 53% intraday on May 30, triggering a circuit breaker halt.

The stock bounced hard after the halt…..climbing 30% within minutes.

No dilution, no ATM, and NASDAQ compliance confirmed in my CEO interview.

Community traders and data show it wasn’t a retail dump. It was a synthetic flush:

Market makers forced the drop

Stop losses and market sells triggered

Big players profited off the spread

CEO Interview Highlights

In my interview with CEO David Jemmett (conducted the same day as the halt), we covered:

✅ NASDAQ compliance, they believe they are compliant but cannot do a news release without the letter i hand

💰 Checklight’s warranty coverage increased from $250K to $1 million per incident, at no extra cost to clients

💼 That $1M warranty is now automatically bundled into CyberSimple, the new insurance-linked product

🔁 Over 600 customers, 93% retention, and 75% recurring revenue

📊 EBITDA-positive and improving margins

🚫 No dilution, no ATM usage, and insider alignment

Here are some snap shots of the trading, the whole day and then then a zoom in on the attack:

🟠 Level 2: Stop-Losses and Market Orders — Retail’s Biggest Risk

“Stop losses protect you…..until they don’t.”

How Market Makers Profit Off Panic

Let’s say:

Bid = $0.80

Ask = $0.90

You hit Sell at Market → you get $0.80Someone else hits Buy at Market → they pay $0.90

Market Maker profit: 10¢/share

Multiply that by 100,000 shares? That’s $10,000 in a single flush.

What Happened on May 30

MMs dropped the bid fast to $0.66

Stop losses triggered in a cascade

Retail didn’t sell voluntarily, they were forced out by structure

After the halt? Price bounced immediately

✅ Lesson:

Use limit orders

Avoid visible stop-loss orders in manipulated stocks

Learn to spot obvious trap levels under key support

🔵 Level 3: What the Chart and Data Showed

This is for readers who love VWAP, OBV, and order flow.

✅ Data-Driven Observations:

VWAP dipped with OBV → indicative of smart money movement

Time & Sales revealed sell blocks just below $1.00

SSR (Short Sale Restriction) was active, limiting true shorting

Float shares returned quickly → not sustained selling pressure

Quote from Ice_Wizard:

“This wasn’t retail capitulation. OBV dipped with VWAP. SLs got blown out. And the float was returned quickly — this was structured.”

Fun Fact: 74% of CISO trades yesterday were on the darkpool. Weird, huh!?

🔶 Level 4: Price Targets and Resistance (Michael Abourayan Analysis)

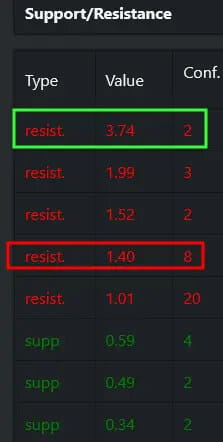

Michael (@Muskvoice) laid out a beautiful resistance map:

RSI @ 70% → $2.27

RSI @ 80% → $3.83

Key resistance: $1.40–$1.50 (must break)

Blue sky zone: $1.70 → $3.74

Fibonacci extensions match volume resistance points

Quote:

“If we pass $1.40 with volume, it’s blue sky until $3.74.”

Glossary of Terms (for New or Curious Readers)

💡 VWAP (Volume Weighted Average Price):The average price a stock traded at throughout the day, weighted by volume. Traders use VWAP to identify whether a stock is trading above (bullish) or below (bearish) its fair value.

📉 OBV (On-Balance Volume):A momentum indicator that adds volume on up days and subtracts it on down days. Used to detect whether "smart money" is buying or selling behind the scenes.

🧠 RSI (Relative Strength Index):A measure of how overbought or oversold a stock is, ranging from 0 to 100.

Over 70 = overbought

Under 30 = oversold

🔦 Lit Exchange:Public, regulated stock exchanges like NASDAQ or NYSE where all orders are visible in the order book.

🕳️ Dark Pool:Private exchanges where large investors trade without revealing orders in real-time. Often used to hide big buys/sells and avoid moving the price.

⛔ Circuit Breaker:A trading halt triggered when a stock’s price moves too quickly (up or down), usually over 10% in 5 minutes. Used to prevent panic and give markets time to stabilize.

🚩 NASDAQ SHO Threshold List:A list published by exchanges (under SEC Regulation SHO) identifying stocks with persistent delivery failures — meaning shares are being sold but not properly delivered. Being on this list suggests potential naked short selling or systemic settlement failures, and can be a red flag for manipulation.

🧱 Stop-Loss Order:An automated order to sell a stock when it falls below a set price. Helpful for risk management - but often used by market makers to trigger forced selling.

📈 Spread Capture:How market makers profit. They buy at the bid, sell at the ask, and pocket the difference - especially when retail uses market orders.

📉 SSR (Short Sale Restriction):When a stock drops 10% or more in one day, shorts can only sell on an uptick, limiting how aggressively they can push the price down.

✅ Final Thought:

This wasn’t a collapse. It was a shakeout.

CISO is profitable. Its platform is outperforming major players like CrowdStrike in pricing and bundled warranty coverage. And now the community is awake.

The mechanics are public. The trap was visible. The recovery was fast.

If you’re looking for a real asymmetric setup - this is what it looks like.

Oh — and one more thing: $CISO is now on the NASDAQ SHO Threshold List, meaning delivery failures are piling up. Whether it’s manipulation or mechanical — someone’s losing control of the float.

XO,Penny Queen

Call to Action:

If you found this post helpful, informative, or empowering, please share it.

💬 Comment below with your take on what happened🔁 Repost this on X or Discord📬 Subscribe to get my next deep dive early

Want more of this kind of breakdown? Let me know what you want to see next.

Together we can outsmart the noise. Let’s do it loud, proud, and unapologetically retail