- Stock Therapy with Penny Queen

- Posts

- This Stock Trades at 4% of Its Legal Claim. History Says It Could Hit 30% Before the Verdict

This Stock Trades at 4% of Its Legal Claim. History Says It Could Hit 30% Before the Verdict

Inside Panthera’s $1.58 Billion Arbitration Against India

Read This First - No, Really

As we assemble our portfolios for 2026 and hedge against potential economic downturns, I’m about to show you something uncorrelated to traditional markets - a legal special situation that could multiply your money 5-10x over the next 18 months. But here’s the thing: if you buy this blindly because “litigation stocks go up,” you’re going to panic-sell at the first volatile move and lose money.

This opportunity requires understanding WHY a tiny mining company can credibly demand billions from a sovereign nation, HOW these cases actually work, and WHAT makes this specific situation extraordinary.

This isn’t a typical stock pick. It’s a binary bet on international law with a fascinating twist - even if they lose the case, the journey to the verdict historically delivers multi-bagger returns. But you need to understand the mechanics to hold through the volatility.

Take 15 minutes. Read the whole thing. If you don’t understand it, don’t buy it. If you do understand it, you’ll know exactly why I’m putting capital at risk here.

TL;DR - The 60-Second Version

(But seriously, read the full thing if you’re considering investing - this is complex and you need to understand the risks)

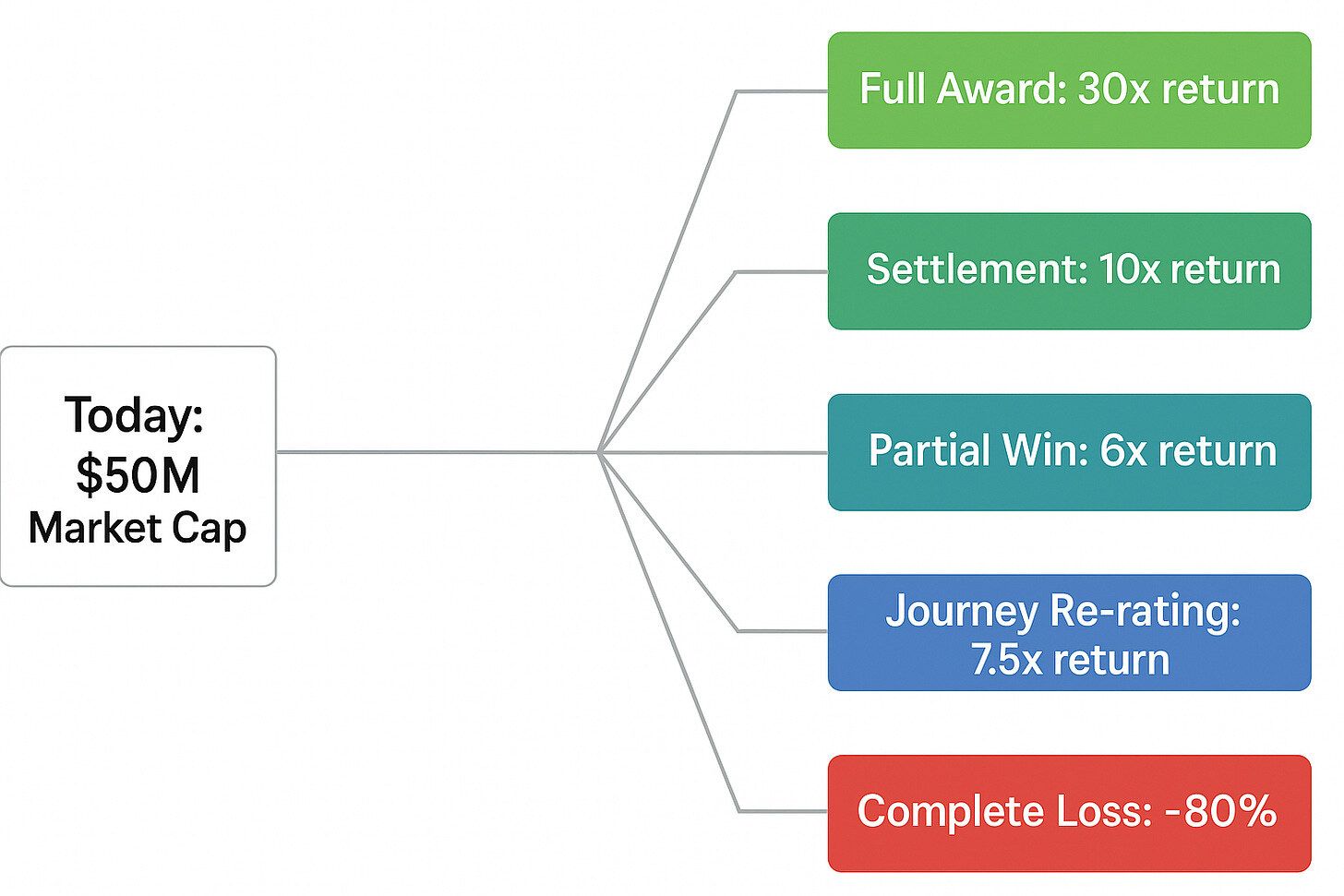

The Situation: A small mining company ($50M market cap) is suing India for $1.58 billion after the government retroactively changed laws and took their gold project.

Why It’s Credible:

A professional litigation funder vetted this for 12 months and invested $13.6M

It’s based on international treaty law, not hopes and prayers

India has paid similar claims before (Vodafone: $2B, Cairn Energy: US$1B)

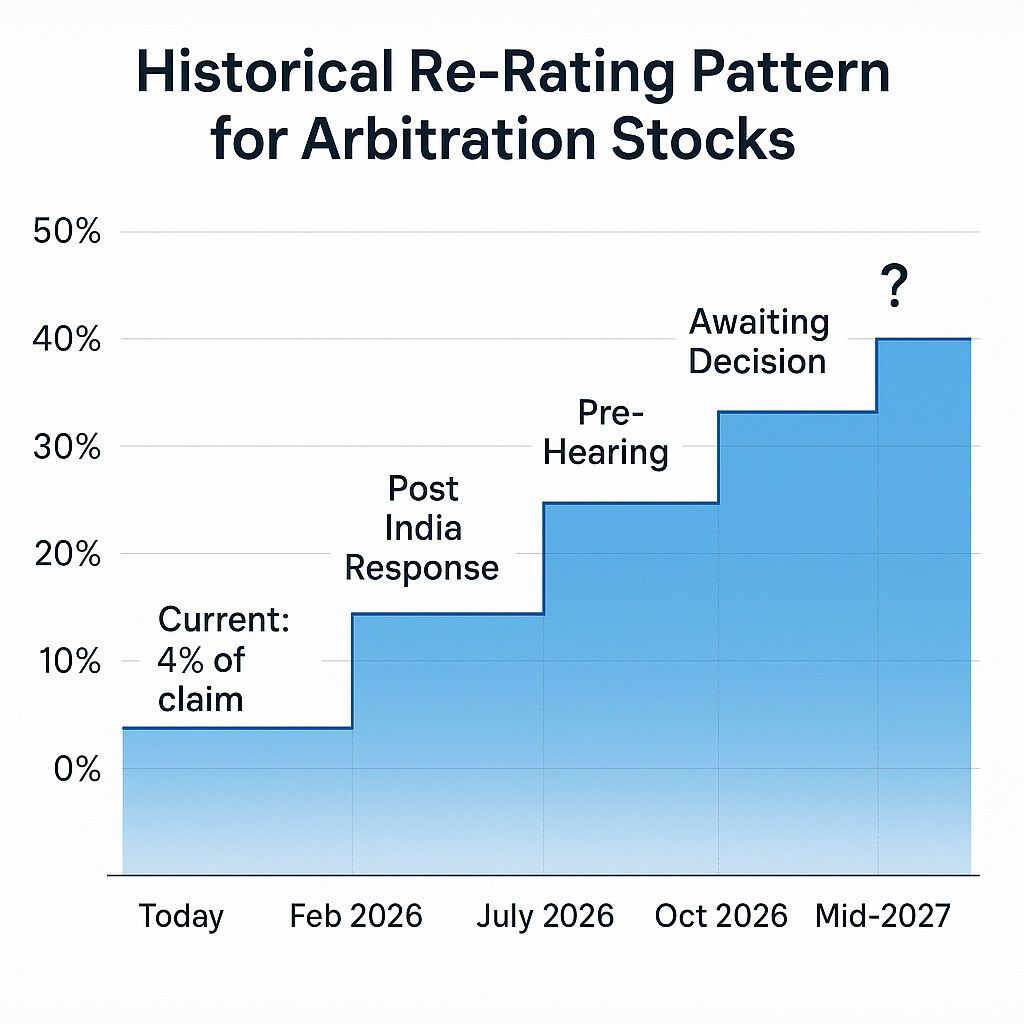

The Pattern: Similar legal stocks have historically re-rated from 5% to 30% of claim value as the award approaches. Panthera trades at 4% of the claim number today. If that pattern holds, that’s a potential 7.5x return just on the journey to verdict. (Also, remember that the current claim amount is likely to go up as the current gold price gets priced into the claim amount.)

The Timeline: Major hearing December 2026, Phase 1 decision mid-2027. Multiple catalysts in between that could move the stock.

The Opportunity: Based on historical precedent, the stock could multiply even before any verdict. If they win, it could be 30x+.

The Risk: This is a binary bet. If they lose, the stock could drop 80%. This is NOT a safe investment.

Bottom Line: The asymmetry is compelling - but only if you understand what you’re buying. Read the full analysis below before making any investment decision.

Executive Summary: The Asymmetric Bet

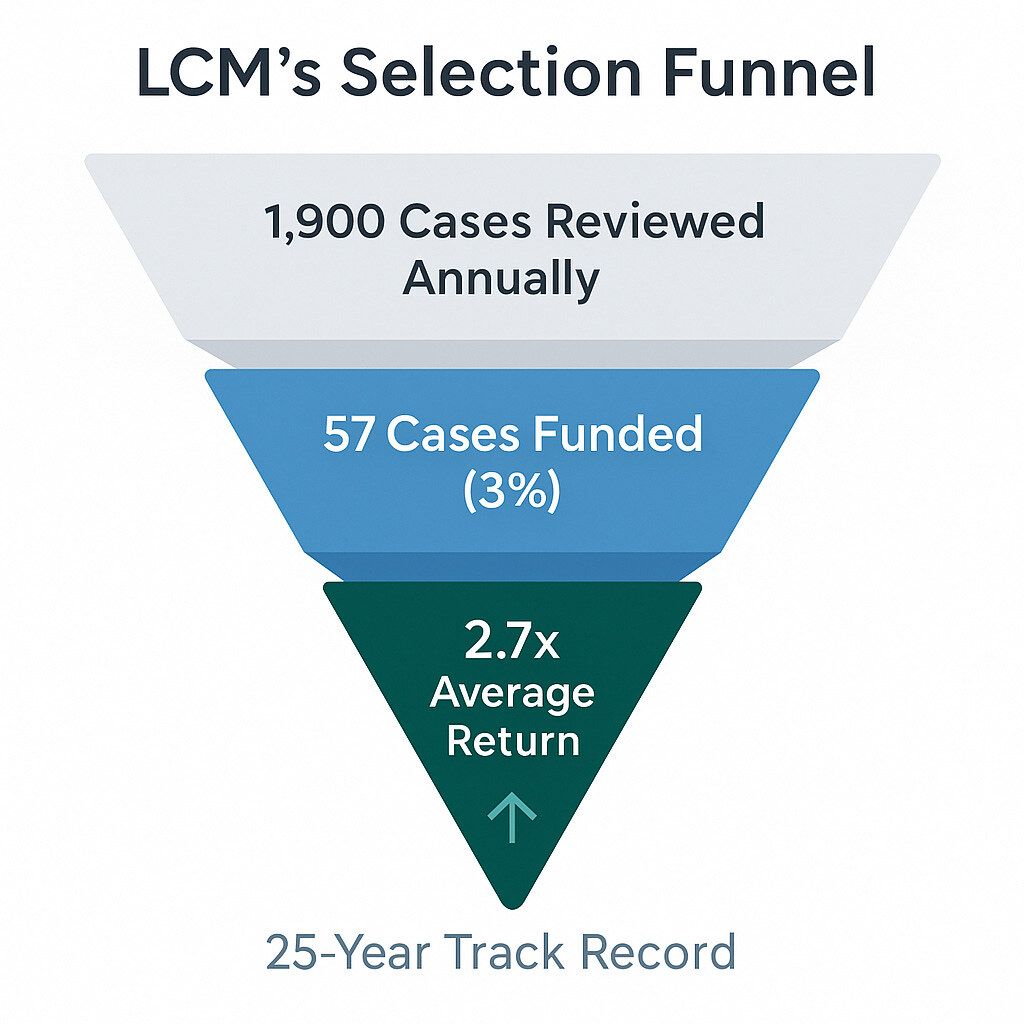

Panthera Resources trades at ~$50 million. They’re claiming $1.58 billion from India. The math is simple: that’s 30x+ upside if they win fully, but history suggests even partial victories deliver multi-baggers. More importantly, Litigation Capital Management - a firm that reviews thousands of cases annually and funds only 3% - has backed this case with $13.6 million in non-recourse capital after 12 months of due diligence.

Part I: Why 2026 Will Be The Re-Rating Year

The Perfect Storm of Catalysts

While most investors chase AI stocks and crypto, treaty arbitration offers something different: defined catalysts with historical precedent for how markets react. Panthera’s 2026 calendar is loaded:

February 27, 2026: India must reveal its defense (Counter-Memorial)

July 17, 2026: Panthera’s reply exposes weaknesses in India’s case

October 23, 2026: Final written arguments completed

December 14-19, 2026: The main event - Phase One hearing in The Hague

According to VSA Capital’s October 2025 research, this compressed timeline is “considerably shorter” than the typical 3-5 year arbitration process. Each filing will generate news flow, analyst coverage, and potential re-rating events.

The Re-Rating Playbook

VSA Capital notes that peer arbitration cases typically trade at 30-50% of award value by the time of decision. Panthera currently trades at less than 4% of its claim - the gap represents the opportunity.

Historical pattern from similar cases:

Filing stage (now): 2-5% of claim value

After respondent’s memorial: 10-15% of claim

Pre-hearing: 20-30% of claim

Awaiting decision: 30-50% of claim

Even reaching the low end of pre-hearing valuations implies a 5x return before any verdict.

Part II: The Treaty Framework Most Investors Don’t Know Exists

What Are Bilateral Investment Treaties?

Think of them as insurance policies for foreign investors. When Australia and India signed their treaty in 1999, they promised to protect each other’s investors from arbitrary government actions. Break that promise? The investor can bypass local courts entirely and demand compensation from an international tribunal.

The Key Protection Triggers:

Expropriation: Taking assets without fair compensation

Fair & Equitable Treatment: Changing rules retroactively

Denial of Justice: Local courts refusing effective remedies

These aren’t suggestions - they’re binding international law enforceable in 170+ countries through the New York Convention.

Part III: The Litigation Funding Validation

When Smart Money Validates Your Thesis

According to LCM’s public filings, they maintain a long-term track record of 2.7x returns on invested capital. Their most recent annual report (September 2024) shows they’ve completed over 3,000 cases since inception.

LCM spent 12 months conducting due diligence on Panthera’s case, reviewing what the company described as 1,900 pieces of evidence before committing $13.6 million in non-recourse funding.

Recent LCM Mining Successes:

GreenX vs Poland: October 2024 award of $330M (LCM funded $12M) - resulting in 6x return for LCM

Indiana vs Tanzania: July 2024 settlement of $90M (LCM funded $4.6M)

As LCM’s CEO Patrick Moloney stated about another mining case: “This investment...could become one of the most successful in LCM’s history.”

Part IV: The Panthera Opportunity

The Bhukia Gold Project: What India Took

Indo Gold’s Investment: 21 drill holes, JORC-compliant resource of 1.74M oz gold

India’s Own Valuation: The Geological Survey of India (GSI) reported 7.17M oz gold in the same area (VSA Capital Research, October 2025)

The Taking: 2021 law change eliminated Indo Gold’s rights retroactively

The Smoking Gun: India immediately auctioned the same project for $60M upfront + 65% royalty on future mined gold

The Hidden Catalyst: Gold Price Indexation

The original $1.58 billion claim was calculated at historical gold prices. VSA Capital notes that the claim methodology likely uses prevailing commodity prices, meaning if gold remains elevated (currently ~$4000/oz), the final award calculation could be substantially higher than the original filing.

While we can’t predict exact numbers without seeing the damage model, even a 20% increase due to gold appreciation would add $300M+ to the potential award.

Management’s Capital Return Commitment

Unlike many legal situations where proceeds disappear into corporate ventures, Panthera’s management has indicated that the majority of any award would be returned directly to shareholders. This transforms a legal claim into a potential capital distribution event.

Part V: The Risk/Reward Framework

What Can Go Wrong?

Complete Loss: Tribunal sides with India (residual value ~$10M for African assets)

Jurisdiction Failure: Unlikely after recent procedural victory

Collection Issues: India has honored similar awards (Vodafone: $2B)

What Can Go Right?

Based on VSA Capital’s peer analysis and historical precedents:

Full Award: $1.58B+ = 30x+ current market cap

Settlement (avoid precedent): $500M = 10x

Partial Win: $300M = 6x after costs

The Journey Alone: Re-rating to 30% of claim = 7.5x

POTENTIAL OUTCOMES

The Asymmetry

VSA Capital maintains a $1.05 (80p) price target, representing 336% upside from current levels. This target appears to reflect only the journey, not the binary outcome.

PAT:LSE 3-month chart

Why This Opportunity Exists

No US Listing (An OTC listing is the next logical step)

Complexity keeps retail investors away

Time Horizon too long for momentum traders

Size too small for institutions

As we construct portfolios for an uncertain 2026, assets uncorrelated to Fed policy, AI valuations, and geopolitical tensions deserve consideration. Treaty arbitration operates on legal merits, not market sentiment.

Next Steps & Critical Dates

The 2026 Calendar

Q1 2026: Possible OTC listing for US investors

February 27, 2026: India’s Counter-Memorial

July 17, 2026: Panthera’s Reply

December 14-19, 2026: Phase One Hearing (The Hague)

Mid-2027: Expected Phase One Award

How to Buy It

Panthera trades on London’s AIM market under ticker PAT. Currently there is no U.S. OTC listing, though this would be the next logical step for a company seeking broader investor access.

For now, U.S. investors can purchase through brokers that allow foreign share trading such as Fidelity, Interactive Brokers (IBKR), or Schwab Global.

Should an OTC listing materialize, it would likely improve liquidity and visibility, which has historically been positive for comparable small-cap international equities.

About My Involvement

I am selective about the companies I work on because my portfolio, reputation, and performance are tied to my results. 45 Degrees Inc., a company owned by a related party, is handling digital advertising for Panthera Resources and will receive 225,000 shares. This is a client engagement, but it is also a conviction position. I only take clients whose fundamentals and timing I personally believe in and that I believe will positively impact my network..

Final Thought: The Professional Money is Already Here

When LCM - with their 2.7x average returns over 25 years - commits $13.6 million of non-recourse capital, when VSA Capital (the company’s broker) maintains an $1.05 target (336% upside), and when management commits to returning proceeds to shareholders rather than empire building, the smart money has already validated the thesis. The question isn’t whether this is real - it’s whether you understand it well enough to hold through the volatility.

Sources: VSA Capital Research (October 2025), LCM Annual Reports, Company filings